While only one-fifth of global companies report that they're employing social commerce to reach their markets, don't be fooled.1 The savviest merchants are already taking this concept -- which combines social media with ecommerce -- to the next level by leveraging payment methods like Venmo.

In doing so, these market leaders are tapping into the trusted circles of their current customers, building relationships with these affinity groups, and transforming the connections into transactions. It's powerful stuff -- and the risk of being left behind this massive shift in online commerce is real.

Here are four ways your company can help elevate its social commerce efforts and stay competitive in the rapidly changing world of online commerce:

1. Find social networks that prioritize commerce

Depending on your market demographic, some social networks may be a better fit for your brand than others. But if you want to ensure that your consumers are purchasing and talking about your product, choosing a social network that prioritizes commerce is key.

Venmo operates at the intersection of commerce and social media. Unlike other digital wallets, Venmo provides its users with a social component so they can comment on purchases, like a great meal at a restaurant with friends, an airline ticket, or a special event.

Because the platform is commerce-first, conversations about purchases in Venmo's social feed are naturally more authentic and meaningful. Brands such as Grubhub and Delivery.com provide great examples of this notion in action: both allow their customers to pay directly with Venmo.

This simple move has wide-reaching impact as people notice their friends’ transactions, and share stories related to buying dinner or sending someone a gift. Posting these activities to a social commerce feed such as Venmo can be far more impactful than simply liking a brand on other social media platforms -- because the transaction is the focus, not a footnote.

2. Understand the power of close, trusted circles

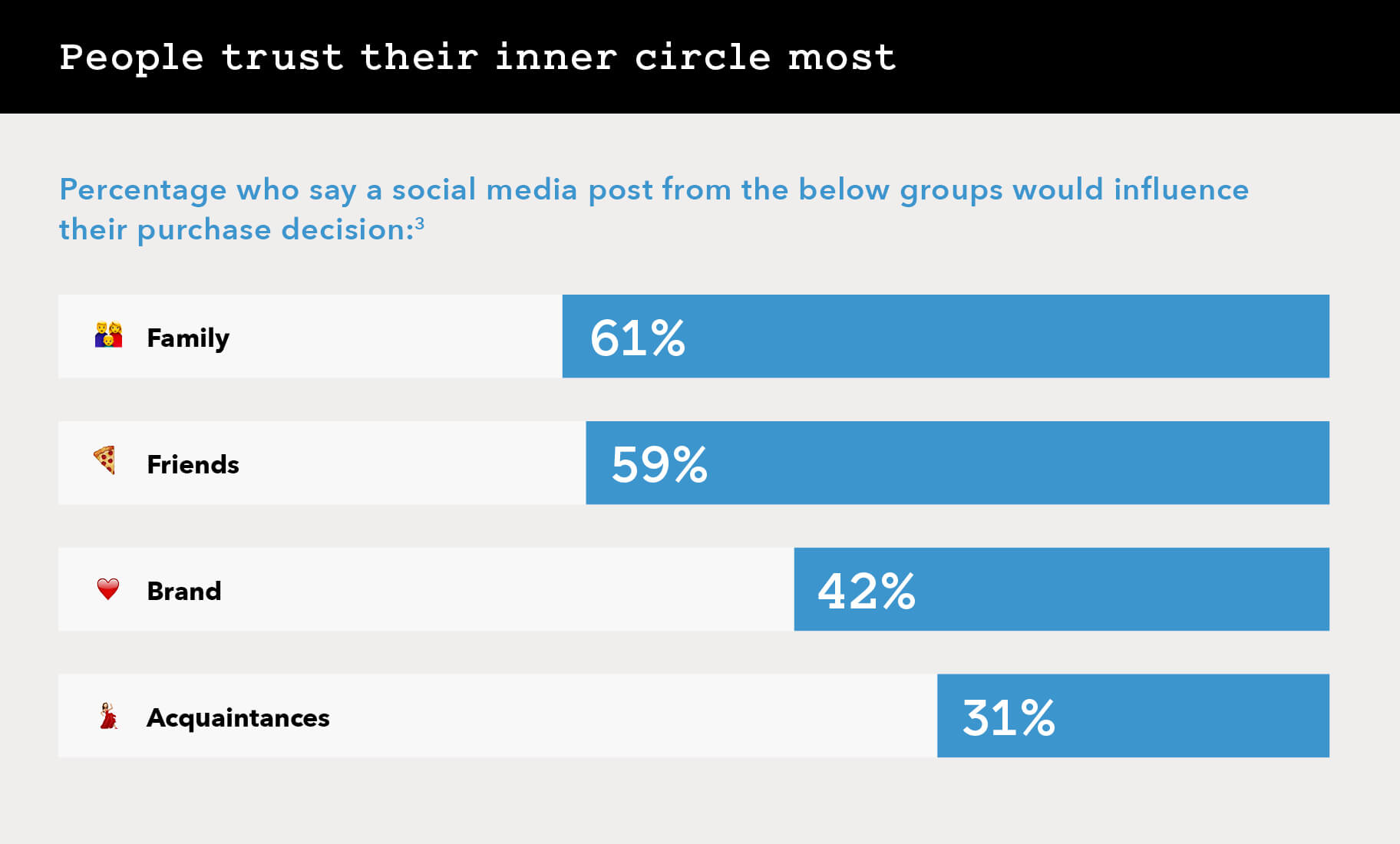

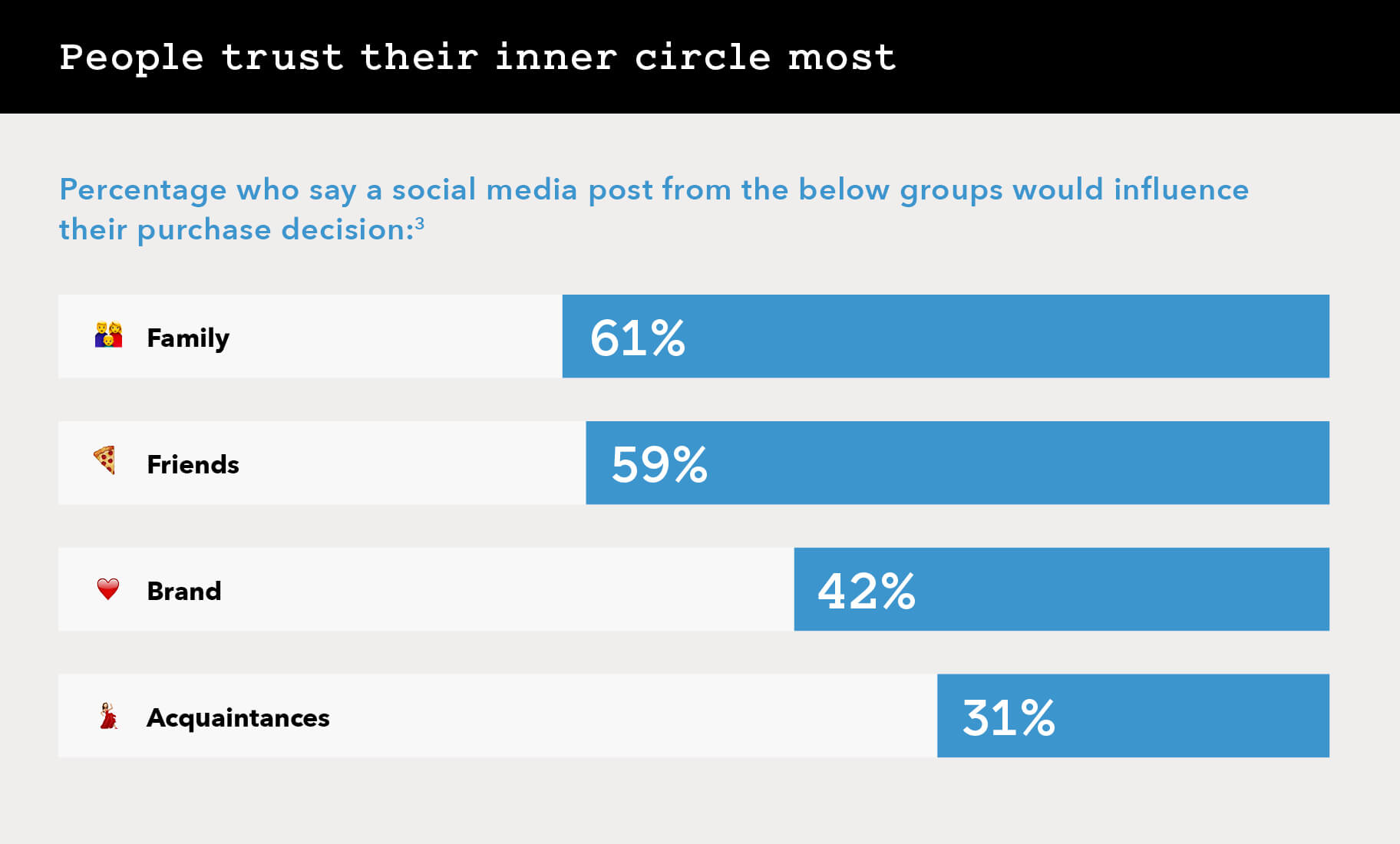

Online social networks give consumers a way to share their life experiences as well as discover new things via the content created by their friends and followers. But as people's social circles have exploded with hundreds or even thousands of friends, consumers are often most interested in keeping an eye on their closest contacts.

These are the people they often turn to the most for advice, recommendations on products, and guidance on what to buy. Consider that 61% of consumers say content from friends or family influences their purchase decisions.2 For brands, tapping into these smaller, trusted circles can be exceptionally valuable. Providing a payment method via Venmo gives companies the opportunity to engage with both their loyal customers and their customers' inner circle of friends. These groups may be small, but their influence is outsized.

3. Put commerce in the context of experiences

Splitting a bill for a meal or paying for a yoga class might not be the best fodder for a traditional social media post. But these actions reflect meaningful experiences in people's everyday lives. Creating and sharing experiences is deeply important, especially for millennials. In fact, half this generation reports that they'd rather spend their money on experiences than on things.4

For businesses, finding ways to put commerce in the broader context of everyday experiences leverages this generational priority. Venmo users, for instance, included the pizza emoji nearly six million times in one year.5 Ordering a pizza may not usually merit a social media post, but the context offered by Venmo creates the right opportunity for users to highlight the experience and share it with their friends. Merchants who understand the importance of experiences and give their customers the chance to share them can more fully integrate into the lives of their customers -- helping build loyalty that can last far longer than one transaction.

4. Make transactions convenient

Even with the powerful forces of social networks influencing consumer decisions, transactions still need to be easy and convenient if you want to earn and keep someone's business. Regardless of how on-point your marketing is, if your purchase process is cumbersome and inconvenient, you can lose sales and customers. For instance, 28% of buyers abandon their purchases because the checkout process is too complicated.6

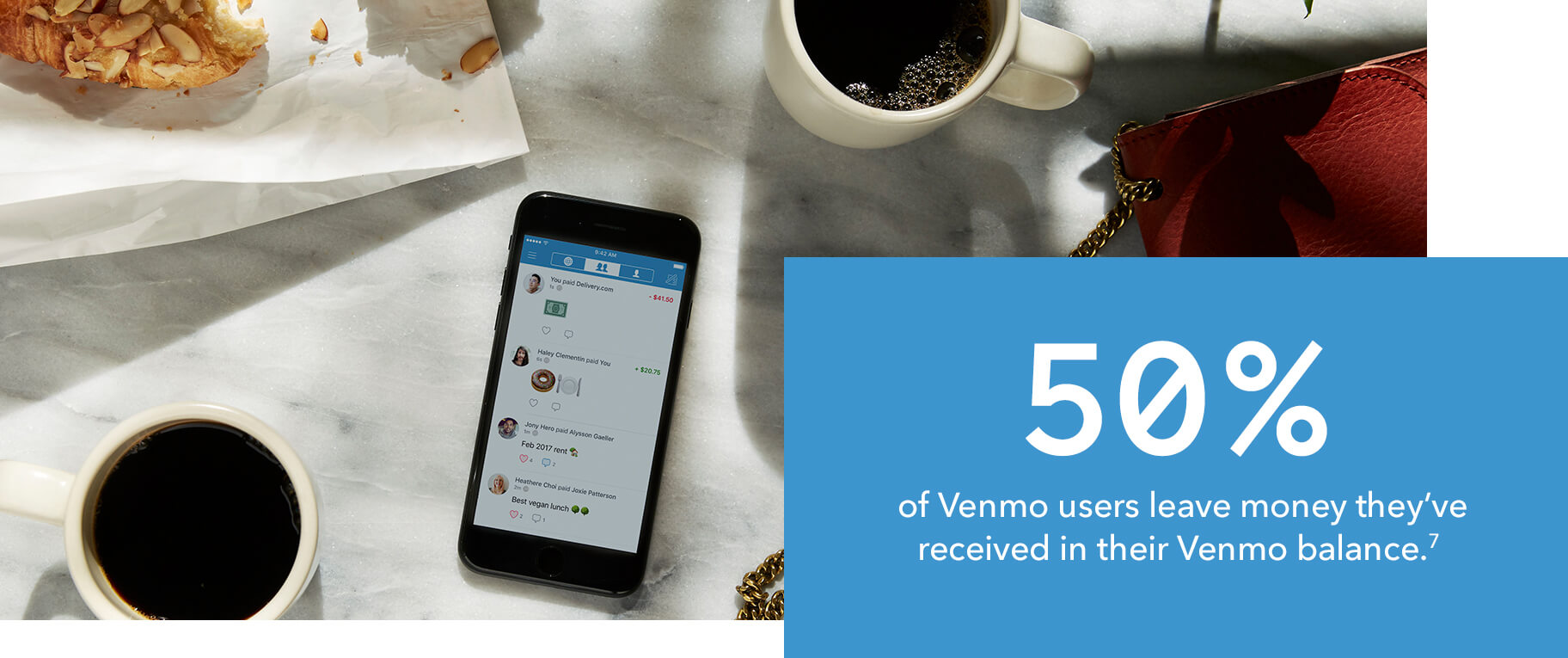

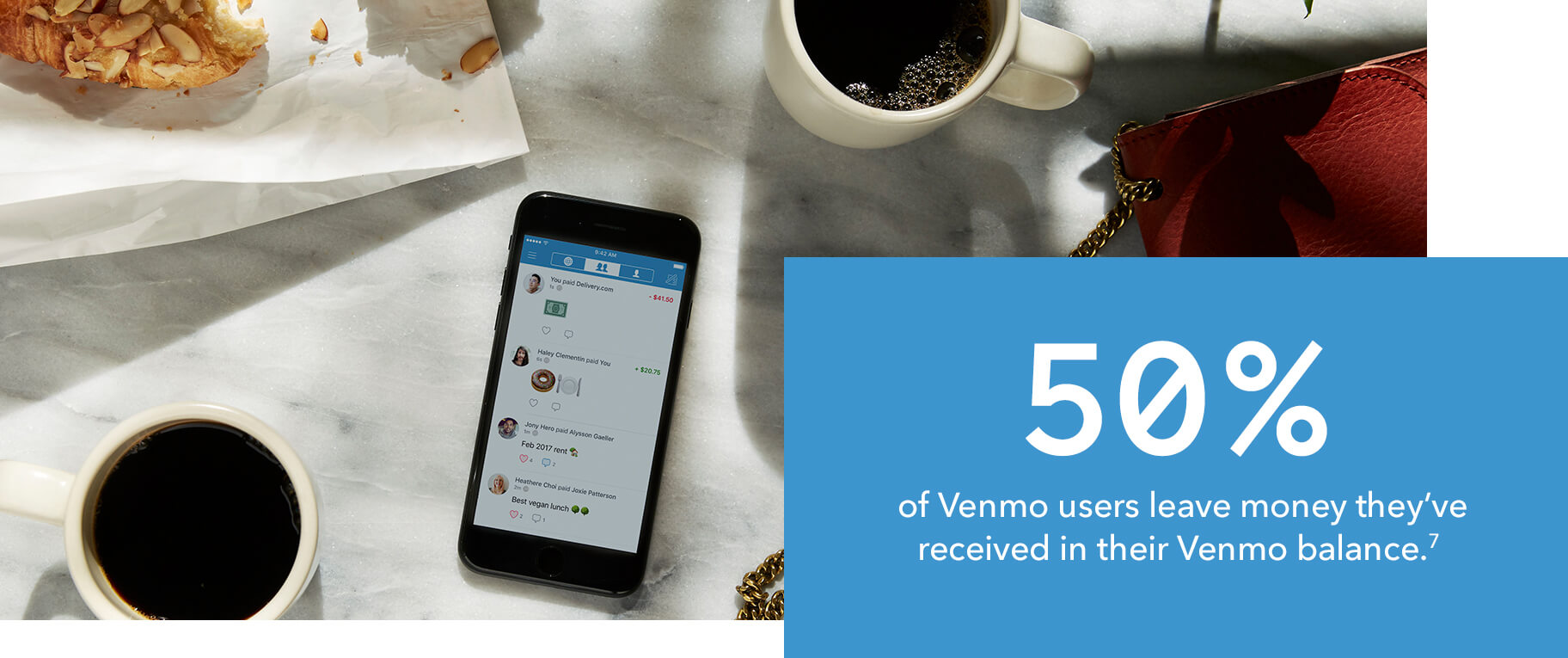

The right payments partner should offer preferred payment methods and features that help remove hurdles to conversion. With Venmo, consumers can access their in-app balances to make purchases and easily transfer money between Venmo and their bank accounts. This is no small matter, given that 50% of Venmo users leave money they've received in their Venmo balance.

More and more, social commerce is becoming how consumers find brands and make transactions. And Braintree can help make your business’s social commerce even smarter. This simple, savvy move ensures that your company is not just dipping a toe into the next generation of ecommerce, but that it’s truly harnessing the power of social commerce to connect with trusted social networks -- and convert social interactions into sales.