Update (October 1, 2019): Visa changed the name of their Visa Chargeback Monitoring Program (VCMP) to Visa Dispute Monitoring Program (VDMP). This went into effect October 1, 2019. For the Visa Dispute Monitoring Program, what has historically been called “first chargeback” is now referenced as “dispute.”

At Braintree, we aim to keep our merchants up to date on the ever-evolving payments industry. Since restructuring in 2016, Visa’s chargeback and fraud programs have undergone some changes, and we recently learned that further changes will become effective October 1, 2019. Our goals here are to outline these new changes and to provide a singular resource for all your Visa program-related needs. Please bear in mind that Visa’s chargeback and fraud program rules are subject to change at Visa’s discretion.

Overview

Visa implemented their chargeback and fraud compliance programs to mitigate excessive disputes and fraud activity. Ultimately, Visa expects merchants to maintain low chargeback and fraud rates so that the integrity of their network is preserved. This blog post will cover the following:

- Updates to the Visa Dispute Monitoring Program (effective October 1, 2019)

- Updates to the Visa Fraud Monitoring Program (effective October 1, 2019)

- Visa Fraud Monitoring Program -- 3DS

- Program transaction caps

- Remediation plan

- Common questions

Visa Dispute Monitoring Program (VDMP) updates

Updated thresholds -- effective October 1, 2019

The VDMP reviews a merchant account’s previous month’s chargeback activity count and divides over that month’s transaction sales count.

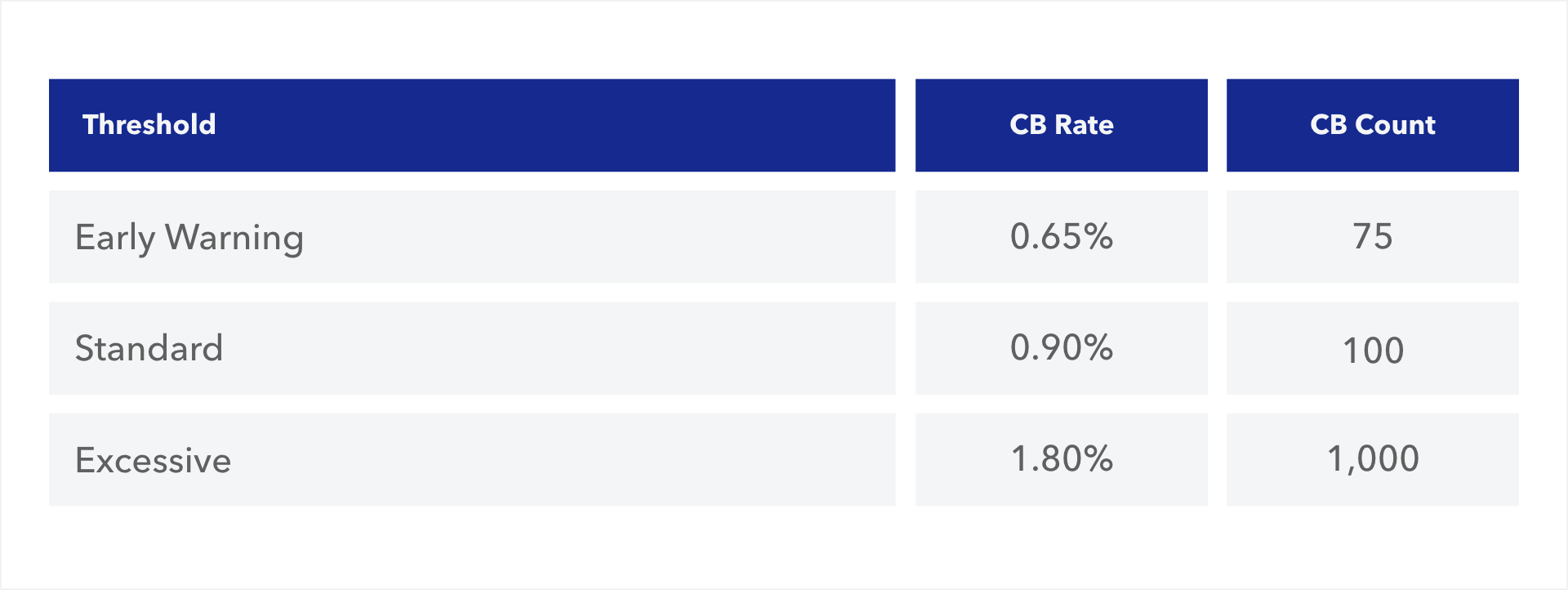

Starting in October 2019, if an account’s chargebacks meet or exceed the following thresholds, the account will be entered into the corresponding Visa program:

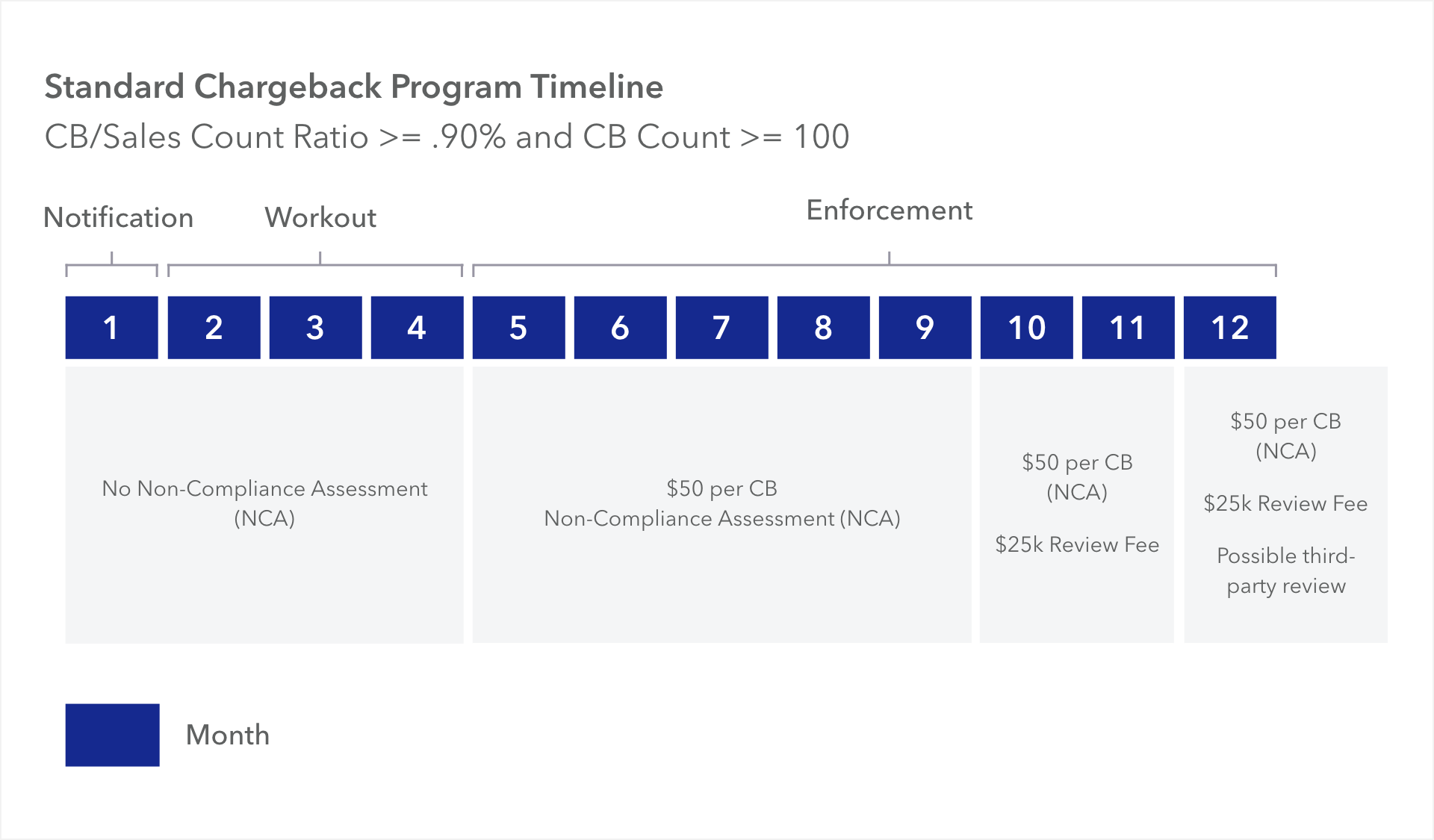

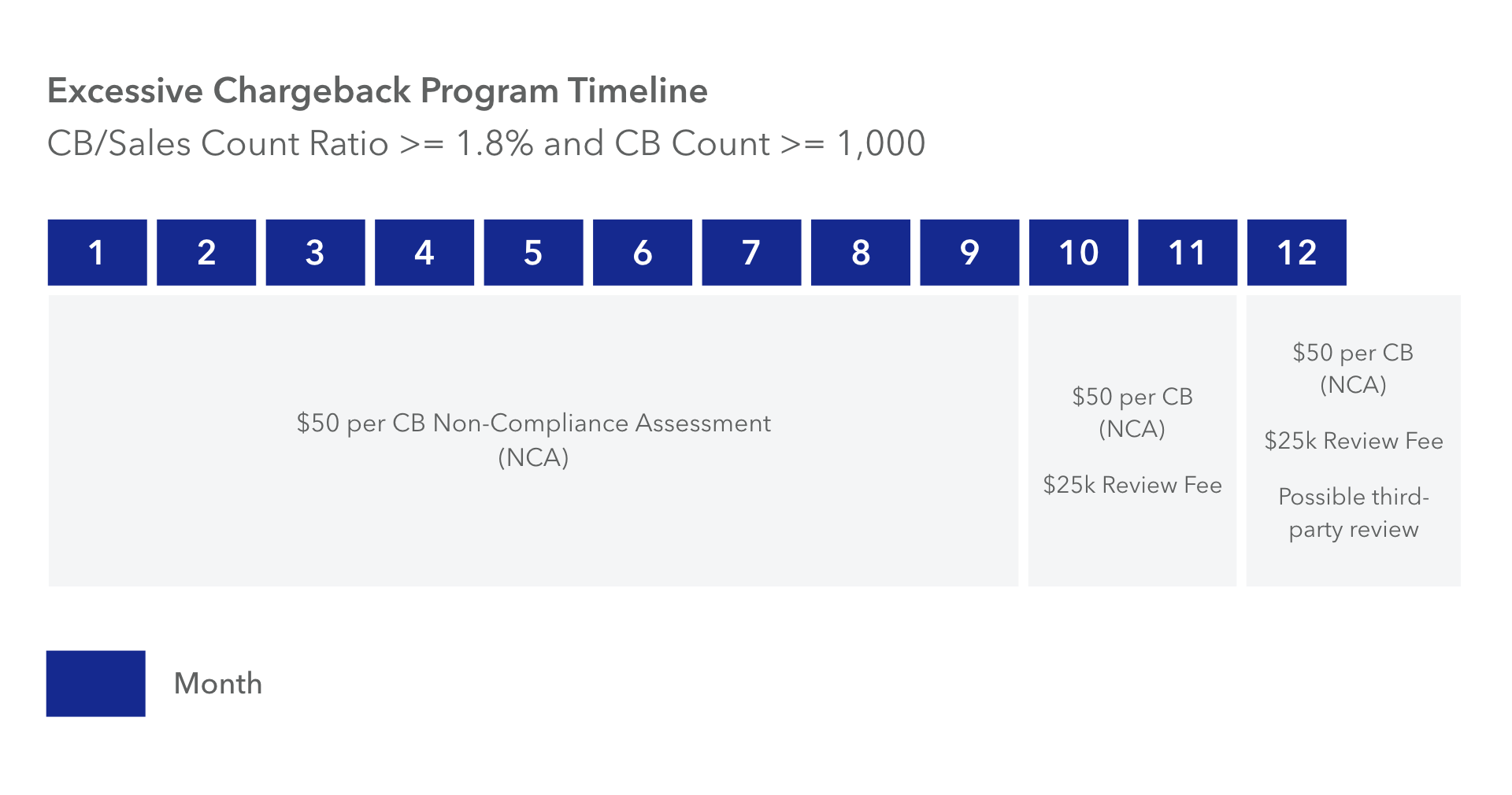

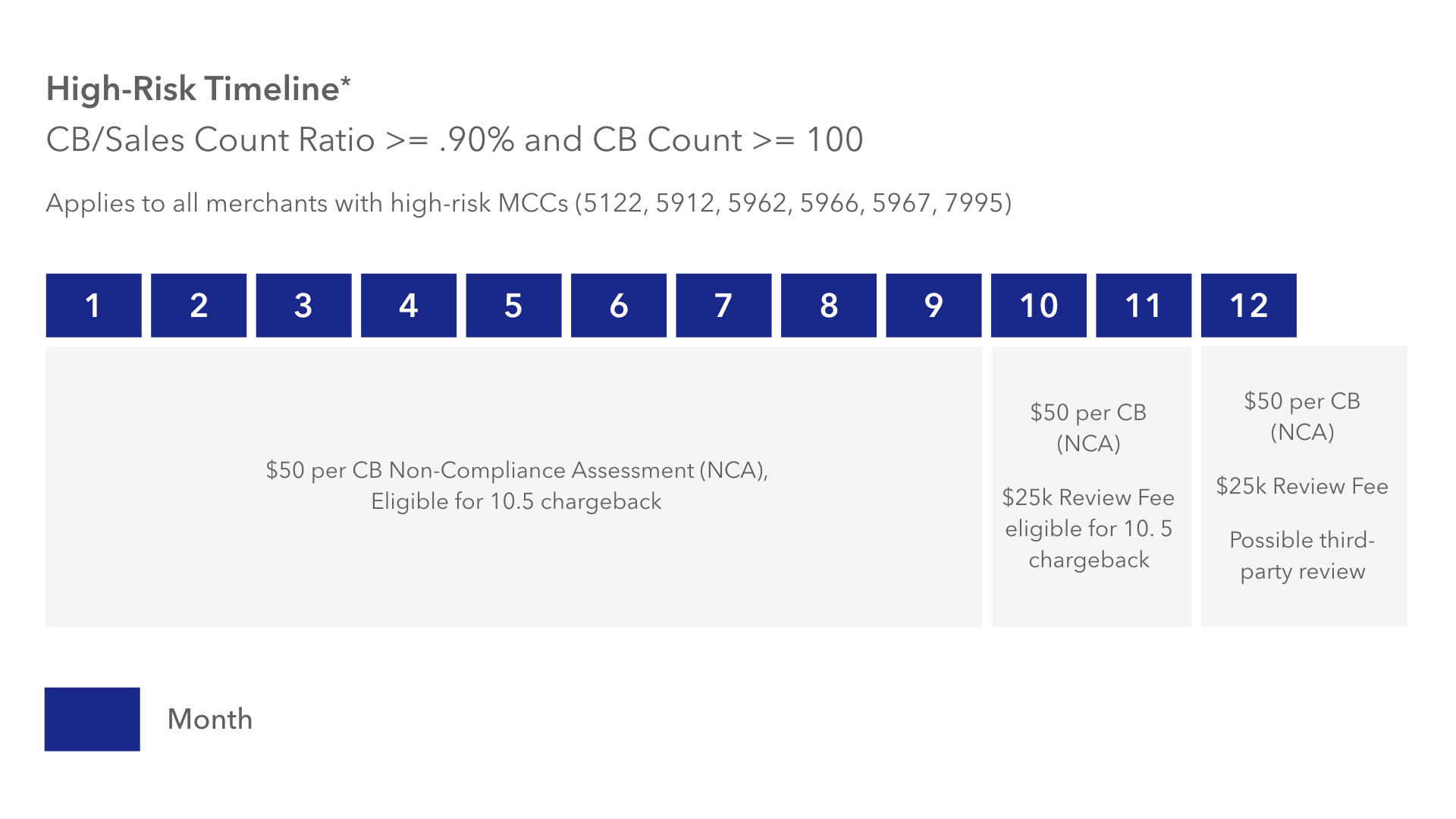

Program timelines

*The account status can be pushed from Standard to High-Risk timeline at Visa’s discretion. This action is based on a review of the account’s performance and/or inappropriate business practices.

*The account status can be pushed from Standard to High-Risk timeline at Visa’s discretion. This action is based on a review of the account’s performance and/or inappropriate business practices.

Early warning notifications

Visa provides Braintree with information on a monthly basis that can give merchants the opportunity to see their official Visa stats and take proactive measures before the account is potentially identified in a fine-eligible chargeback program. There are no fines at the early warning threshold. Early warning notifications will be emailed to merchants when the following thresholds are reached:

75 or more chargebacks and 0.65% or more chargeback-to-sales count ratio

Please note that if the account meets or exceeds thresholds for the standard chargeback program, it may skip early warning notifications altogether.

Visa Fraud Monitoring Program (VFMP) updates

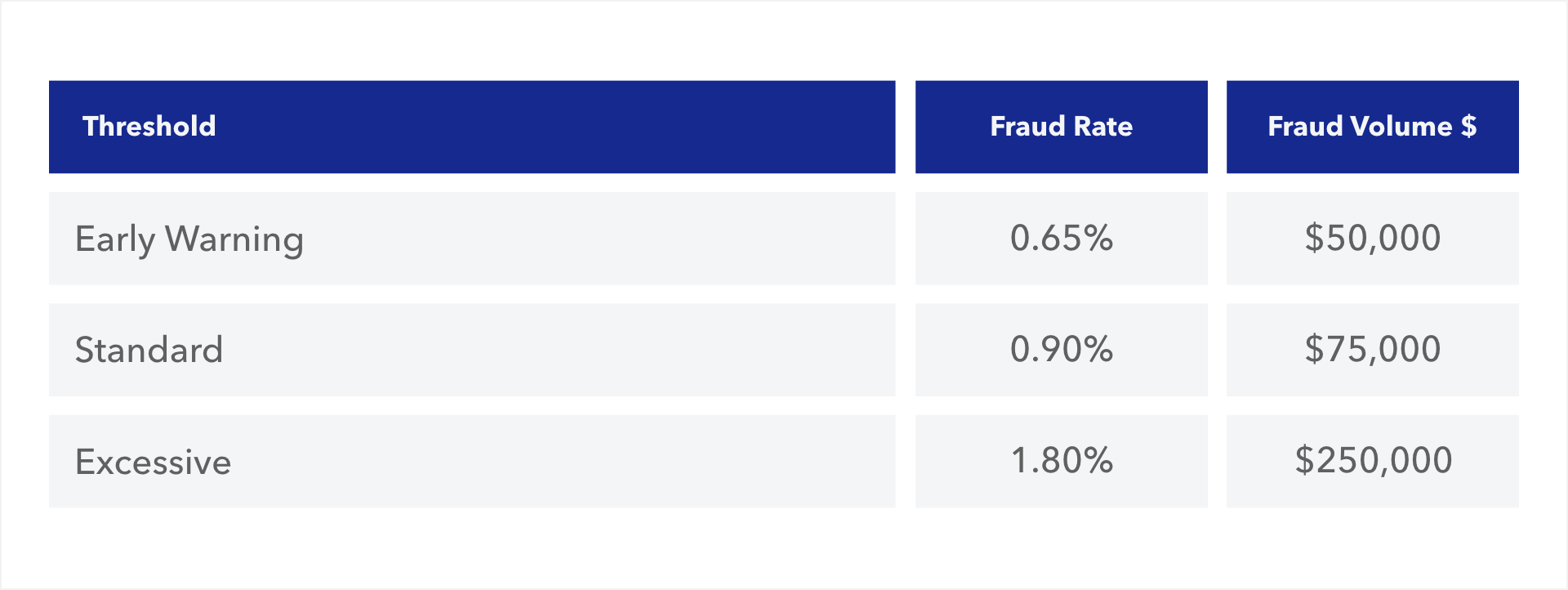

Updated thresholds -- effective October 1, 2019

The VFMP program reviews the previous month’s reported fraudulent transactions against that month’s sales transactions. If the account’s fraudulent transactions are greater than or equal to the following thresholds, it will enter Visa’s Fraud Program:

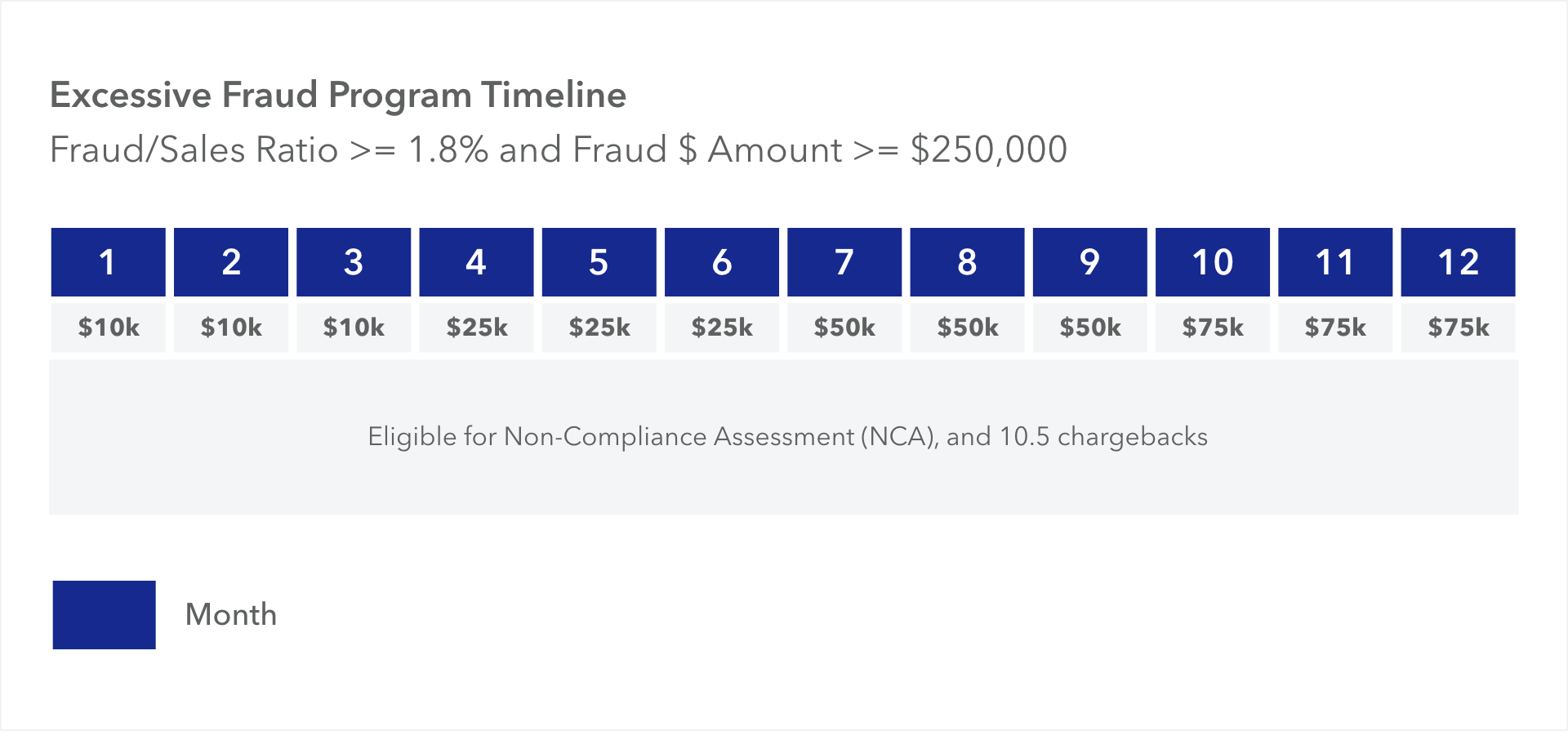

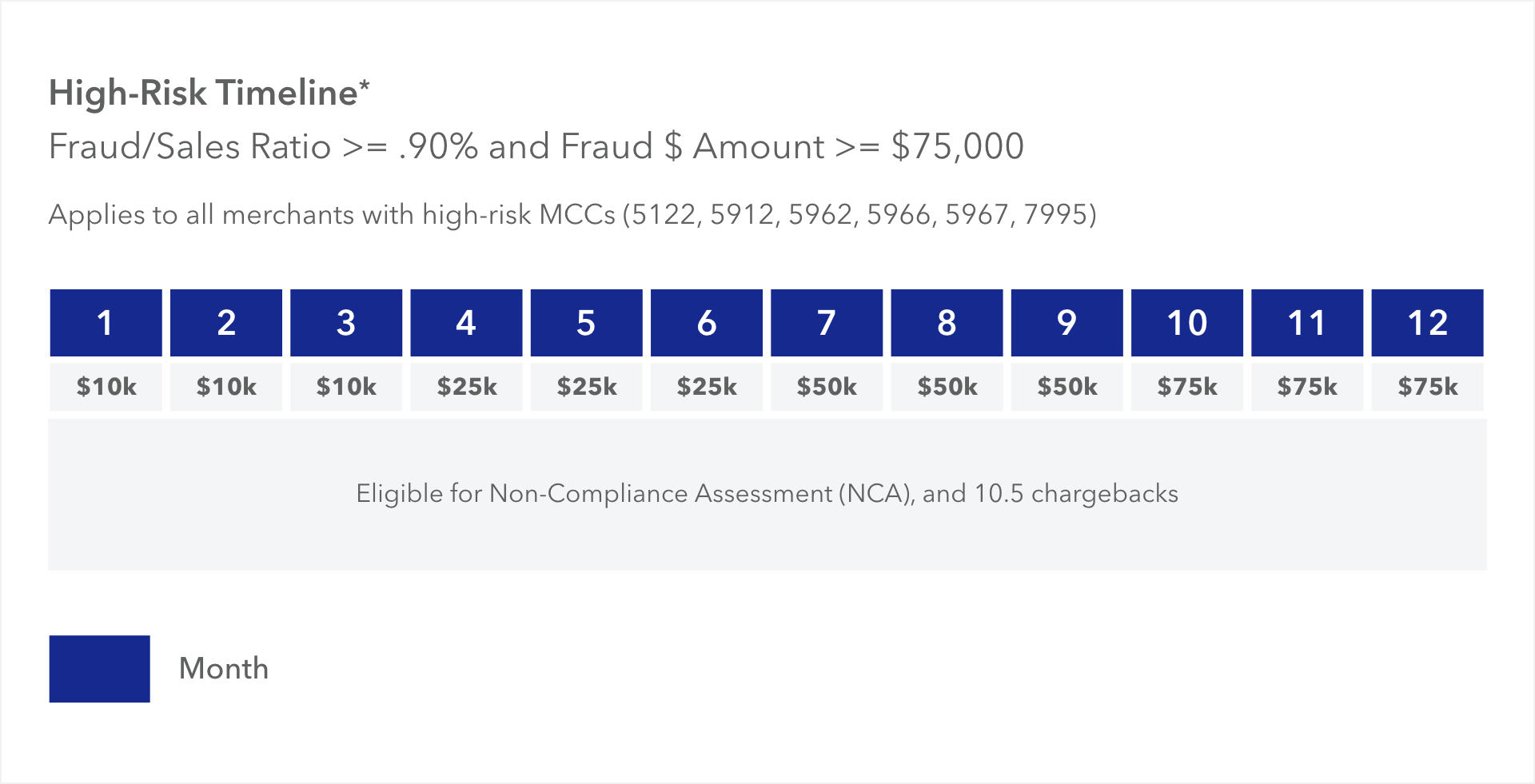

Updated Program Timelines

*The status can be pushed from Standard to High-Risk timeline at Visa’s discretion. This action is based on a review of the account’s performance or inappropriate business practices.

*The status can be pushed from Standard to High-Risk timeline at Visa’s discretion. This action is based on a review of the account’s performance or inappropriate business practices.

Early warning notifications

Visa provides Braintree with information on a monthly basis that can give merchants the opportunity to see official Visa stats and take proactive measures before the account is potentially identified in a fine eligible fraud program. There are no fines at the early warning threshold. Early warning notifications will be emailed to merchants when the following thresholds are reached:

$50,000 or more in reported fraud and 0.65% or more in fraud-to-sales amount ratio

Please note that if the account exceeds thresholds for the standard fraud program, it may skip early warning notifications altogether.

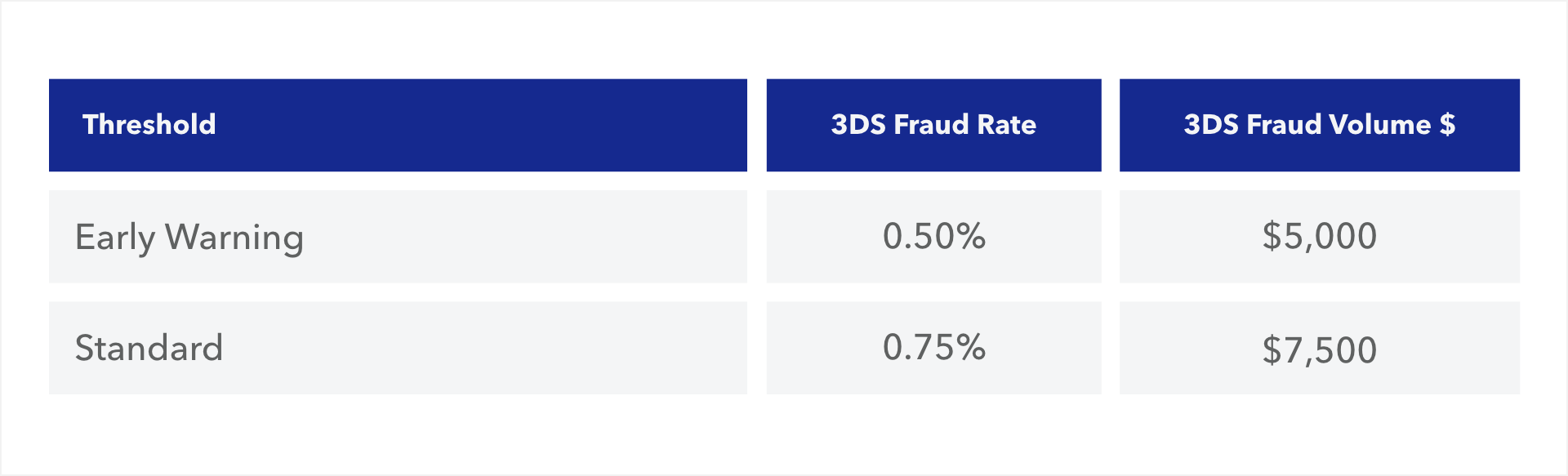

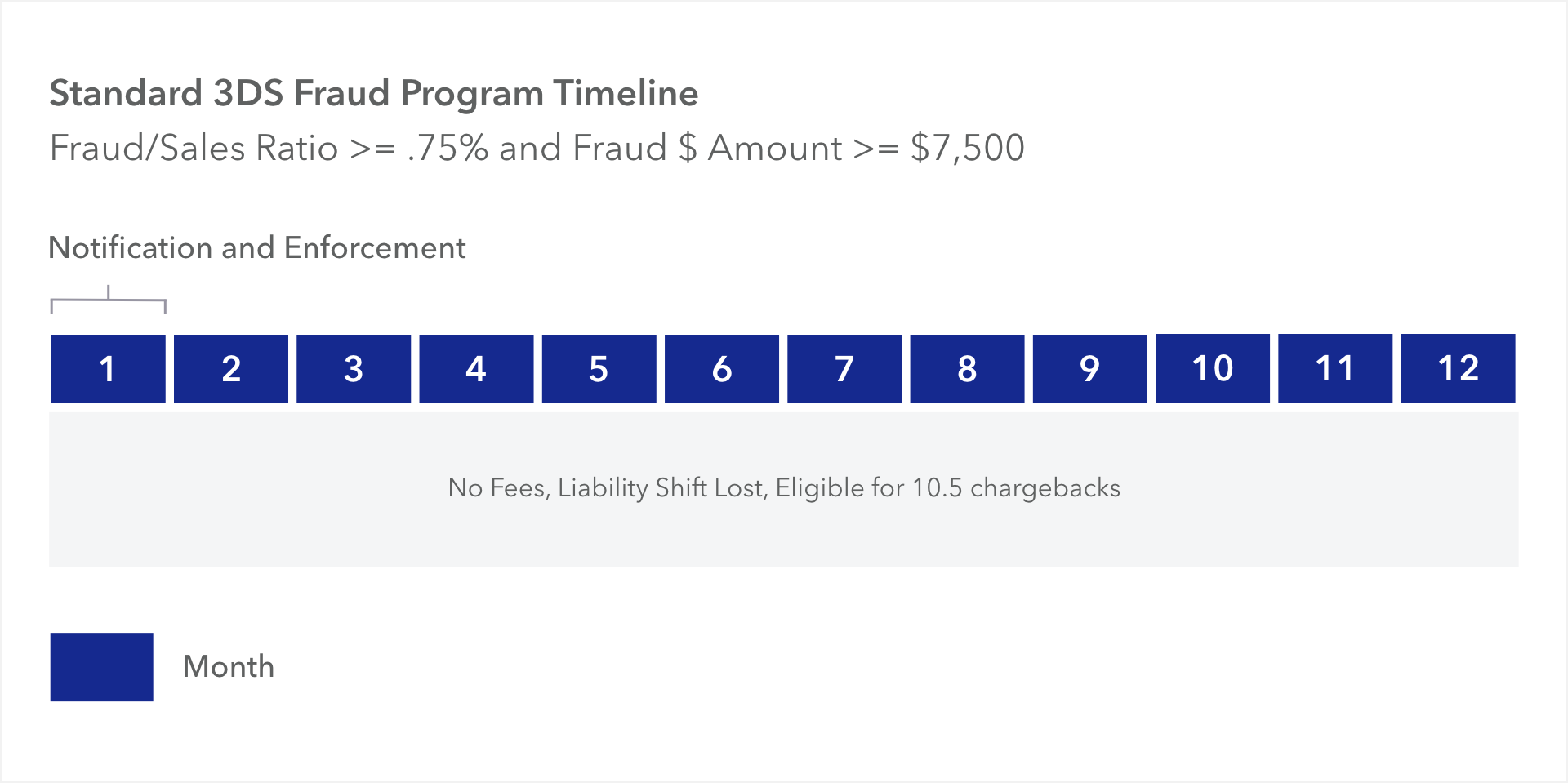

Visa Fraud Monitoring Program-3DS (VFMP-3DS)

Thresholds -- effective October 1, 2018

The VFMP-3DS program reviews the previous month’s reported fraudulent transactions against that month’s sales transactions. This program is only applicable to merchants that have accounts domiciled in the United States, and only 3DS traffic is calculated. If the account’s 3DS fraudulent transactions are greater than or equal to the following thresholds, the account will enter Visa’s 3D-Secure Fraud Program:

Timelines

If a merchant hits Month 1 Standard of the VFMP-3DS program, they will immediately lose liability shift protections on their Visa 3DS transactions until the account is removed from the program. To exit the program, merchants must be below Standard Thresholds for three consecutive months.

Early warning notifications

Visa provides Braintree with information on a monthly basis that can give merchants the opportunity to reduce fraud levels before the account is identified in this program. Early warning notifications will be emailed to merchants when the following thresholds are reached:

$5,000 or more in reported 3DS fraud and 0.50% or more in 3DS fraud-to-sales amount ratio

Please note that if the account exceeds thresholds for the standard fraud program, it may skip early warning notifications altogether.

VDMP and VFMP/VFMP-3DS caps

VDMP chargeback cap

Visa will cap the total number of chargebacks at 10 per card number and merchant account. For example, if there were 50 chargebacks received for a single card under one merchant account, just 10 of them would be counted in the VDMP.

VFMP/VFMP-3DS fraud cap

Visa will cap the total number of reported fraud transactions at 10 per card number and merchant account. For example, if there were 50 fraud transactions received for a single card under one merchant account, just 10 of them would be counted in the VFMP or VFMP-3DS.

Remediation plan

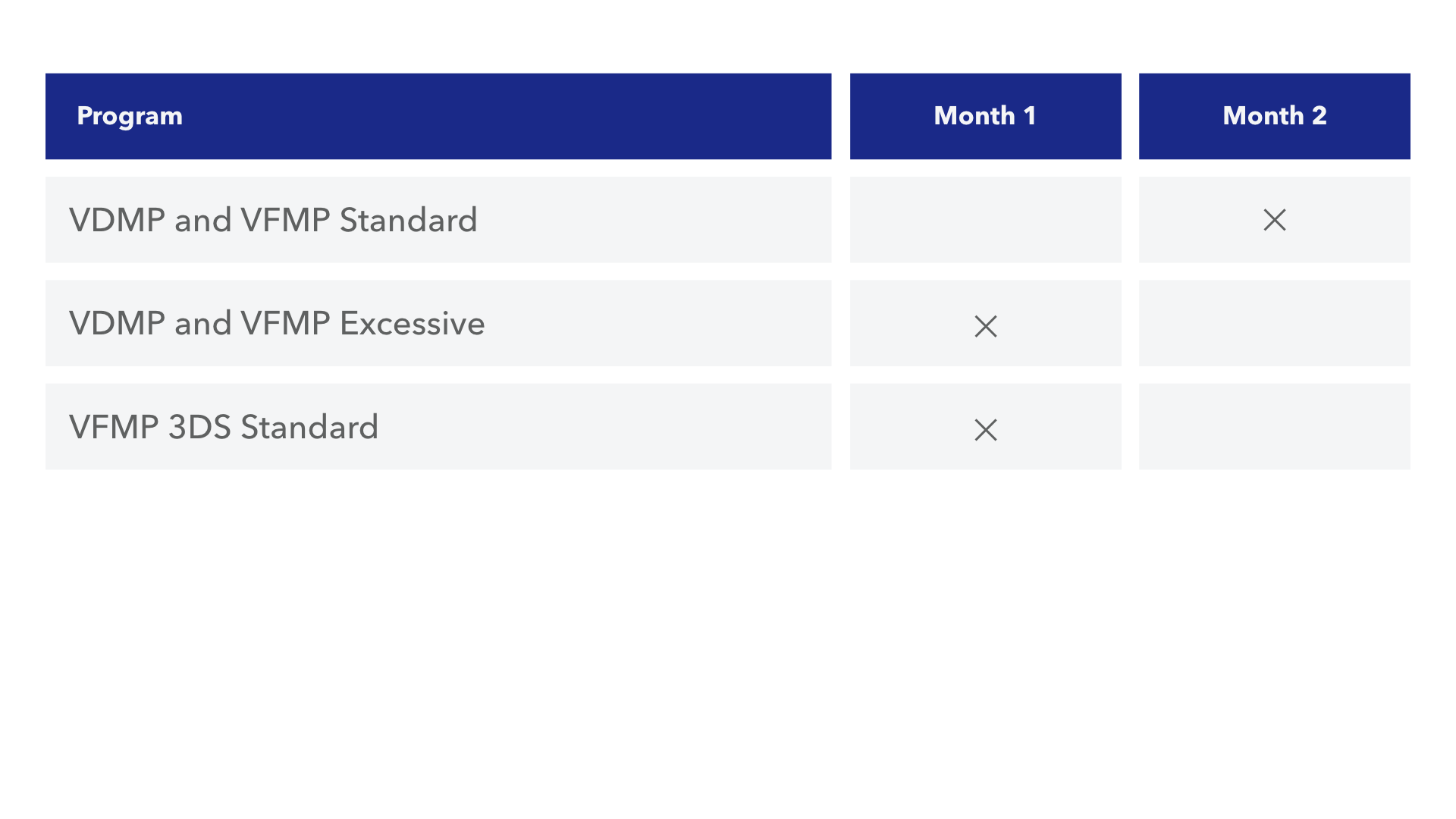

When the account hits the following thresholds and months, a remediation plan is due:

The goal of a remediation plan is to show Visa that steps are being taken to mitigate fraud and chargebacks. We’ll ask for the following details when a remediation plan is due:

- Business description

- Events leading to the increased chargebacks and fraud

- Actions taken to reduce chargebacks and fraud, including implementation dates

- Description of all fraud tools currently enabled

Common questions

How are Visa chargeback ratios calculated?

Chargebacks opened in a calendar month / the same month’s sales.

Example: June chargebacks / June sales

How can I calculate my Visa chargeback ratios?

Please check out our blog that reviews how merchants can calculate their ratios, and how Braintree can help reduce them.

How are merchants identified by Visa?

By merchant descriptor.

How do I exit a Visa program?

Merchant must be below Standard Thresholds for three consecutive months.

What were previous Visa program changes?

Do won chargebacks count against my Visa ratio?

Yes. Regardless of outcome, if a chargeback opens, it is counted against ratio.

Are pre-arbs and retrievals counted in the VDMP?

No. Only chargebacks count against the ratio.

I issued a refund on this transaction, does it still count toward my chargeback numbers?

Yes. If a chargeback opens against an already refunded transaction, it is counted against the ratio.

If my account enters a Visa program, what happens next? What is required?

When the account enters a program, the Braintree Disputes team will reach out and offer to schedule a call to review Visa program details. The goal of the call would be to share our analysis and advice, including chargeback ratios, chargeback drivers, mitigation strategies, and program requirements/timelines. Throughout the course of the program, we’ll monitor the account and keep merchants updated on chargeback standings, account standing, possible fines, and ratios.

This transaction was from November 2018, so why is this chargeback counted in February?

Per Visa rules, chargebacks are counted against an account in the month they are issued.

What is reported fraud?

Similar to a chargeback, cardholders report this activity to their card-issuing bank stating they didn’t authorize the transaction. The difference here is that the bank decides whether they will file a chargeback on the reported fraud transaction -- this decision is typically based on what their business rules determine is a good return on investment. In either case, whether or not they decide to file a chargeback, the issuing bank is obligated to report the transaction as fraud to the networks, and these are the records reflected in the VFMP.

What is a 10.5 Visa chargeback?

A 10.5 (fraud) chargeback is applicable for merchants in the VFMP or VFMP-3DS program. A 10.5 chargeback can only be won on transactions that were previously refunded, as there is no recourse when the bank determines a transaction is true fraud.

Why do my numbers vary from what Visa reported?

Chargeback numbers displayed in the Control Panel are considered estimates, as these will differ from the card network's official figures due to multiple factors, including timing differences in reporting, auto-representation, and multiple merchant processors.

Are the program fines included in my Braintree chargeback fee?

No. Program fines issued by Visa are supplemental fees which are not included in the chargeback fee.

I don’t like how Visa calculates these numbers. Can this be changed?

No. By choosing to process Visa credit and debit cards, merchants agree to their mandated rules and regulations.

Braintree is here to help. If you have any questions about these changes, or need clarification around chargebacks in general, please don’t hesitate to contact us.