Chargebacks are a standard part of online payments, though for merchants, the chargeback process can be confusing to navigate at times. That’s why Braintree has a dedicated Disputes team to help you navigate through the chargeback-resolution flow and provide guidance on reducing chargebacks overall.

What is a chargeback ratio and why does it matter?

Credit card networks (e.g. Visa, Mastercard, American Express) monitor a merchant’s chargeback count and chargeback-to-sales ratio on a month-to-month basis. If a merchant reaches the thresholds set by the card network, the merchant could be flagged for one of the card network’s mandated chargeback monitoring programs. These programs require remediation and may carry fines levied by the card networks.

In general, the card networks consider a chargeback-to-sales ratio exceeding 1% in a calendar month to be high. For a merchant’s account to be removed from a chargeback monitoring program, the merchant’s chargeback-to-sales ratio must be below this threshold for two to three consecutive months, depending on the card network. For a real-world example of this process, see our previous blog posts on the Visa Chargeback Program.

How do I calculate my chargeback ratio?

Estimated* chargeback ratios can be calculated via the Braintree Control Panel by dividing the number of first chargebacks -- the initial chargeback received on a transaction that excludes second chargebacks or pre-arbitrations -- opened in a given month by the number of sales. While that formula can be used to estimate the ratio, each card network has its own specific formula:

Visa, Discover, and American Express:

- Ratio = Chargebacks opened in a calendar month / the same month’s sales

- Example: February chargebacks / February sales

Mastercard:

- Ratio = Chargebacks opened in a calendar month / the previous month’s sales

- Example: February chargebacks / January sales

Visa calculates chargeback activity on merchant descriptor, including dynamic descriptors. If you’re using dynamic descriptors, this is something to keep in mind when calculating your Visa chargeback ratio. Mastercard, on the other hand, calculates chargeback activity on individual merchant accounts.

Here are some examples showing how those differences could have an impact on an account standing in the programs overall:

Example 1

A business has three merchant accounts using the same descriptor:

Visa could aggregate the activity across all three accounts into one single chargeback ratio.

Mastercard could calculate each of the three merchant accounts separately, resulting in three separate chargeback ratios.

Example 2

A business has one merchant account using two dynamic descriptors:

Visa could calculate activity on the two dynamic descriptors individually, resulting in two separate chargeback ratios.

Mastercard could calculate activity on the entire account as a whole, resulting in one single chargeback ratio.

How do I pull my estimated chargeback data?

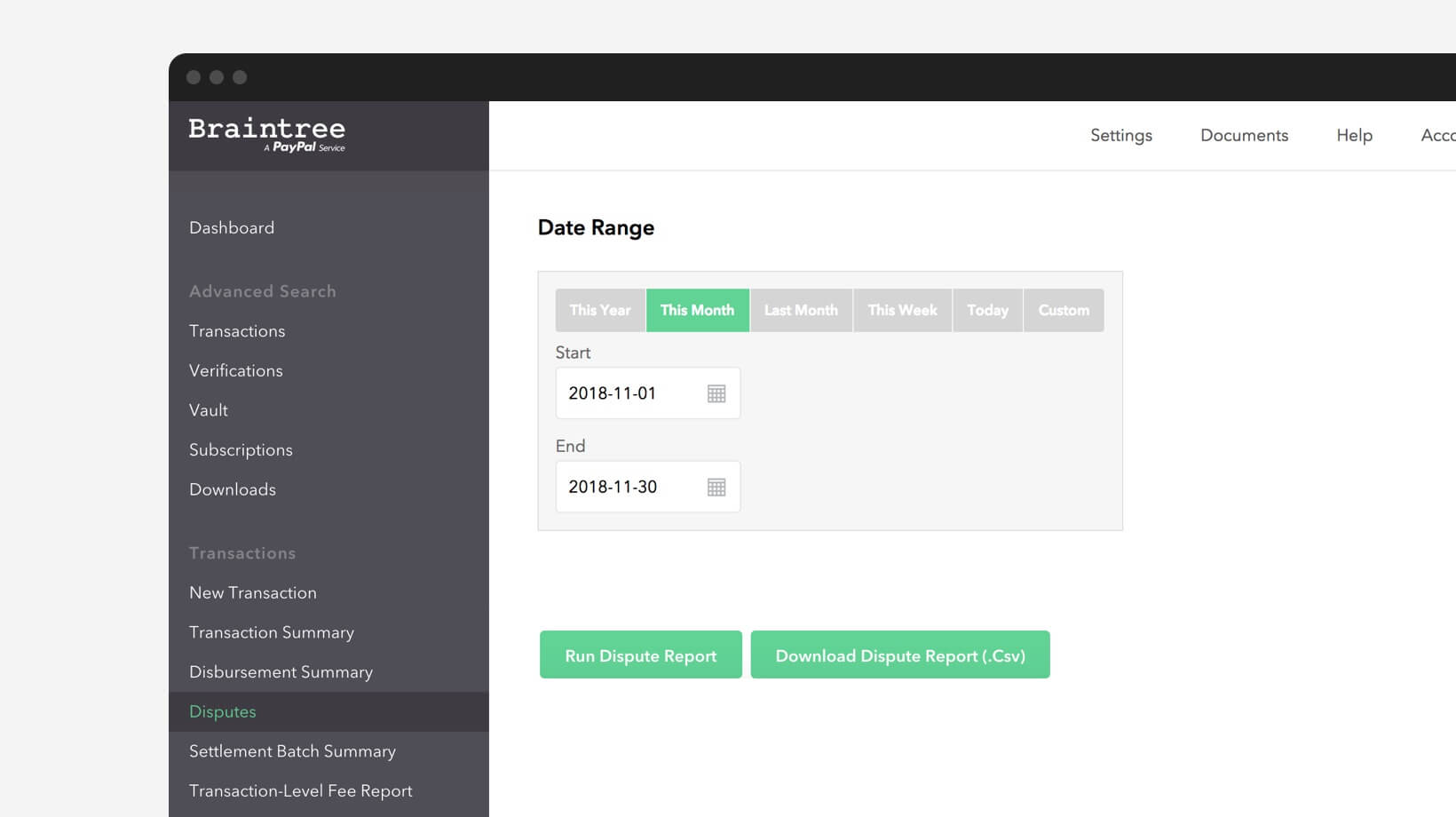

To obtain your estimated chargeback data, download a Disputes Summary report from the Control Panel (note that you must have the “Create, Run, and Download Reports” role permission to access this report):

- Log in to the Control Panel

- Click Disputes on the left-hand column

- Click the green report button

- Enter the timeframe you would like to run

- Download the dispute report

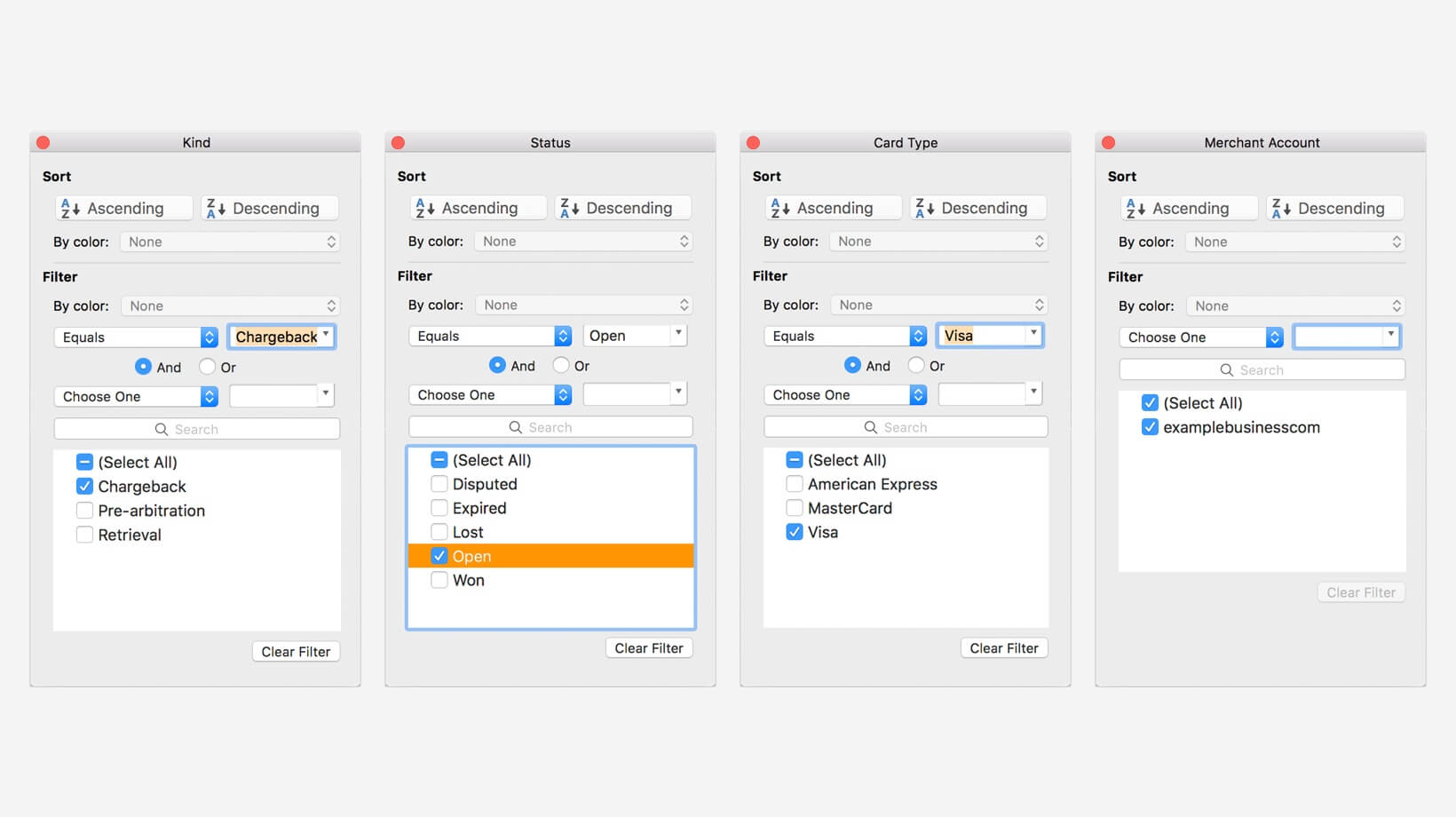

Open the Disputes Summary report in Excel or a similar editor. You'll need to filter the report to find the number of chargebacks opened in a given month:

Kindcolumn should be filtered to "Chargeback"Statuscolumn should be filtered to "Open"Card Typecolumn should be filtered to the card network being calculated (e.g. Visa, Mastercard)Merchant Accountcolumn may need to be filtered to individual merchant accounts for Mastercard calculations and possibly for Visa calculations depending on the descriptors being passed

Keep in mind that if you’re using dynamic descriptors, those aren’t located in a Disputes Summary report. To calculate activity on dynamic descriptors, download a Transaction Report from the Control Panel:

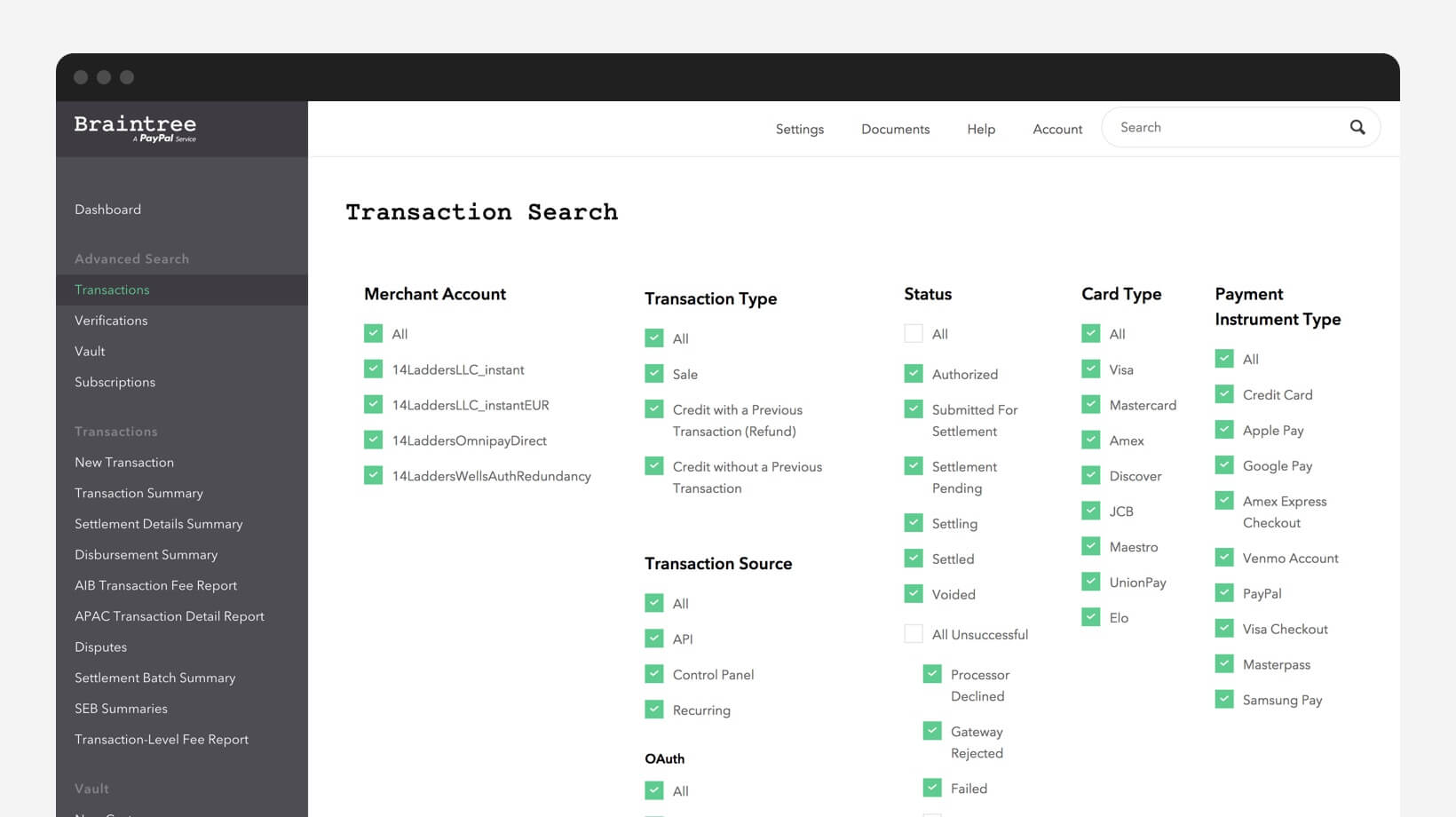

- Log in to the Control Panel

- Click Transactions under Advanced Search

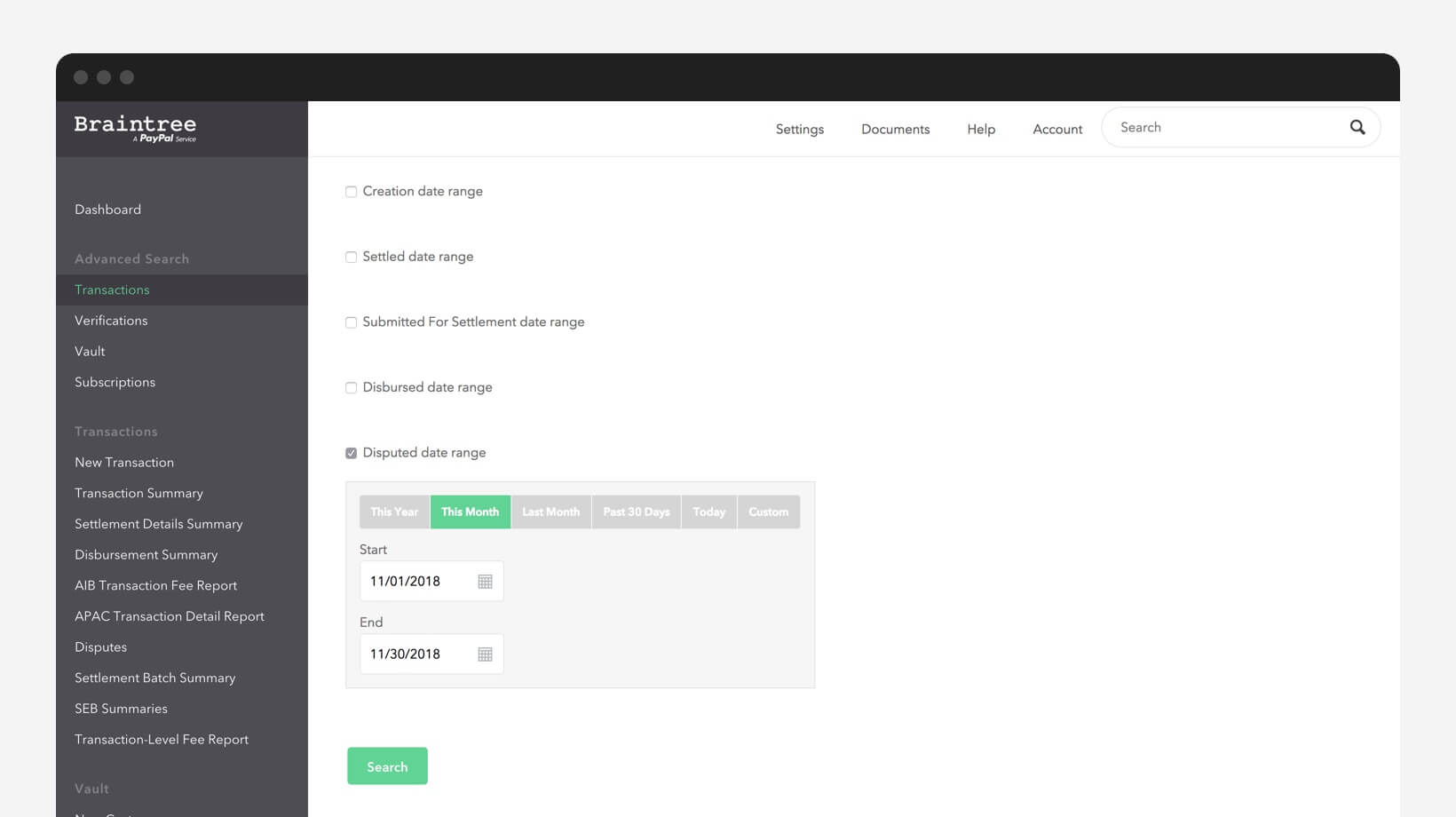

- Unselect “Creation Date Range”

- Select “Disputed Date Range”

- Enter the timeframe you would like to run

- Download the report

Then cross-reference the Descriptor Name (Column S) in your Transaction Report with the transactions in your Disputes Summary Report.

Once your Disputes Summary Report is filtered, you will know the number of chargebacks opened in a given month on a certain card network. From there, divide the number of chargebacks by the total descriptor sales count (Visa) or the total sales count (Mastercard) in a given month according to the formulas listed above.

How does Braintree’s Disputes team help merchants remediate chargebacks?

With top-notch service in mind, Braintree created a value-added process by which we proactively monitor chargeback activity. The goal is to assist merchants in creating strategies that mitigate chargebacks and help merchant accounts in a chargeback program to reach compliance. This is beneficial to merchants as it allows them to take proactive actions to address chargebacks and implement necessary measures before violations occur. Braintree manages this process under a Chargeback Reduction Plan. Our objective is to “AIM”:

A - Analyze the data

I - Identify the issue

M - Monitor progress

We start by identifying merchant accounts that have exceeded our established internal thresholds (which are much lower than the benchmarks set by the card networks.) From there, our Disputes analysts:

- Initiate and maintain merchant communication through the Chargeback Reduction Plan lifecycle

- Help identify why an account is receiving an excessive number of chargebacks

- Help find solutions to mitigate chargeback activity

- Monitor the activity on the account and provide chargeback activity updates

- Guide merchants through the card network-specific remediation plan requirements

In severe cases, unexpected processing behaviors such as carding attacks may result in a sudden spike in chargebacks. Those accounts may be identified in a chargeback program before being flagged by Braintree. When something like this happens, our analysts will still notify the merchant and work with them to implement a Chargeback Reduction Plan.

Calculating and reducing chargeback ratios can be a complicated process for merchants, as there are many aspects to consider. Braintree strives to help merchants not only understand what their chargeback ratio is at any given time, but also help identify ways to reduce their chargeback ratio to stay in compliance with the card networks.

For help calculating estimated ratios or for other chargeback questions, please contact our dedicated Disputes team at disputes@braintreepayments.com for assistance.

*Chargeback numbers displayed in the Control Panel are considered estimates as these will differ from the card network's official figures due to multiple factors, including timing differences in reporting, auto-representation, and multiple merchant processors.